Carport Roof Depreciation, The Financial Incentives Of A Solar Carport Installation

Carport roof depreciation Indeed recently has been hunted by users around us, maybe one of you. People now are accustomed to using the internet in gadgets to view image and video data for inspiration, and according to the name of this article I will talk about about Carport Roof Depreciation.

- Gables House With Porch Mobile Home Porch Porch Design

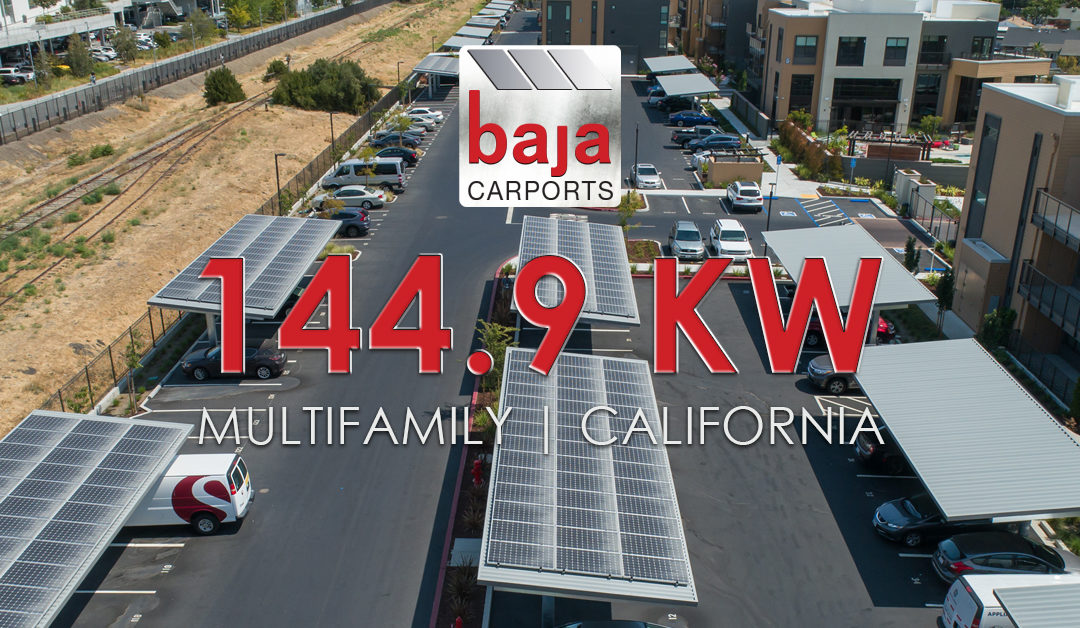

- Westlake Village Apartment Solar Power Carport Go Green Solar Solutions

- Tall Rv Garages Rv Garage On Sale Gatorback Carports

- Momi Yaya S Cajun Pleasure Carport For The Cajun Pleasure

- Old Investment Property Too Old To Depreciate Stop Bwk Group

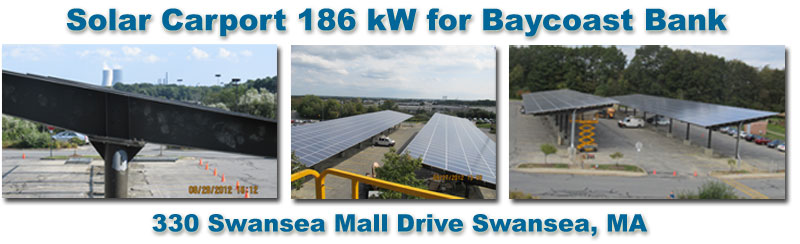

- Solar Canopies Bring Solar Panels To Your Parking Lot Energysage

Find, Read, And Discover Carport Roof Depreciation, Such Us:

- Solar Carports Energistics

- Carports Sunshine Coast Superior Garages And Industrials Superior Garages Sheds Sunshine Coast

- Real Estate Dippoldiswalde Attention Investors Special Depreciation Possible

- What Is A Home Improvement Tom Copeland S Taking Care Of Business

- Carports In Nigeria Design Prices Naijauto Com

If you are searching for Garage And Carport Designs you've reached the perfect place. We have 104 images about garage and carport designs including images, photos, photographs, backgrounds, and much more. In these webpage, we additionally provide variety of images out there. Such as png, jpg, animated gifs, pic art, symbol, blackandwhite, transparent, etc.

168a provides that the depreciation deduction provided by 167a for any tangible property is determined by using the applicable depreciation method recovery period and convention.

Garage and carport designs. Nearly every piece of your structure from the roof paneling trim and gables can be changed to a different color. The commissioner has set a general depreciation rate for a new asset class carports freestanding or lean to under the buildings and structures asset category within the commissioners table of depreciation rates. As such it would be classified in the same category as the rental property.

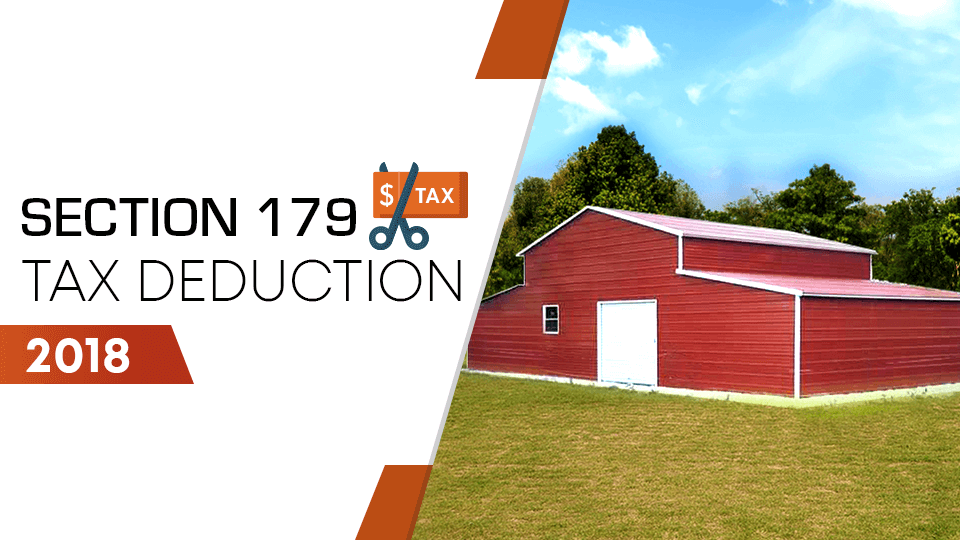

168 set forth the macrs depreciation system. The internal revenue service large and mid size business division rel. Depreciation general depreciation rates provisional depreciation rates disaster related events financial arrangements accruals general special application and processing fees foreign currency branches cfcs and fifs foreign residential rental properties international taxation controlled foreign companies cfcs disclosure exemptions.

The new structure may be considered an improvement to the existing rental property. A carport is a simple lean to structure that is attached to an external wall of a building for support or may be. On their tax return the taxpayers reported the cost of the tobacco barn as 16730 and elected to deduct 6750 as expense method depreciation under irc.

Macrs generally applies to tangible property placed in service after december 31 1986. Boxed eave carports are well designed durable steel structures intended for regions that dont experience heavy snow or heavy rains. There has been much debate over the years concerning open air parking structures and whether the structure for depreciation purposes should be depreciated as 39 year nonresidential real property or 15 year land improvements.

168 set forth the macrs depreciation system. For rental depreciation what asset category does a new shedcarport go into. Depreciation for residential rental property assets.

179 and depreciate the balance of the. Carports are obviously more convenient when placed with your own traffic and accessibility in mind but you may not have considered the elements and future possibilities of construction are just as important for property value. The checklist represents the atos current views on which assets can be depreciated under division 40 and which assets may be eligible for the building write off under division 43.

168a provides that the depreciation deduction provided by 167a for any tangible property is determined by using the applicable depreciation method recovery period and convention.

More From Garage And Carport Designs

- Carport Garage Pictures

- Gambar Kanopi Carport

- Carport Garage Prices

- Carport Roof Loading

- Decorating Carport Ideas

Incoming Search Terms:

- Carports Montgomery Al 334 230 5458 Garages Barns Buidlings Decorating Carport Ideas,

- Need A Roof Roofing Oklahoma City Considerations Tips Whip Roofing Decorating Carport Ideas,

- Carports Brisbane Premium Lifestyles Carport Builder Brisbane Decorating Carport Ideas,

- Bonus Depreciation Archives Commercial Solar Contractor Decorating Carport Ideas,

- Carports South Brisbane Comes With Several Benefits By Excelfit Issuu Decorating Carport Ideas,

- Rental Properties What You Can And Can T Claim Marsh Partners Business Accountants Brisbane Decorating Carport Ideas,

/arc-anglerfish-syd-prod-nzme.s3.amazonaws.com/public/EJI4S5YQFFCVHM224WIJA2JGCQ.jpg)